How to Get a TIN Number for Your Company in Sri Lanka

What Is a TIN and Why Do You Need It?

A TIN (Taxpayer Identification Number) is a unique number given by the Inland Revenue Department (IRD) for your company. It proves your company is officially registered for tax purposes.

Very soon, you will not be able to open a business bank account without a TIN. It’s also needed for:

- Paying taxes

- Filing returns

- Importing and exporting goods

- Registering for other tax types

- Dealing with government offices

How to Apply for a TIN Online

You can easily apply for a TIN through the IRD’s e-Services portal. To begin, visit the e-Services website, go to the taxpayer registration section, and select "Registered Company" from the dropdown menu. Then, follow the steps below and enter your company’s details as needed.

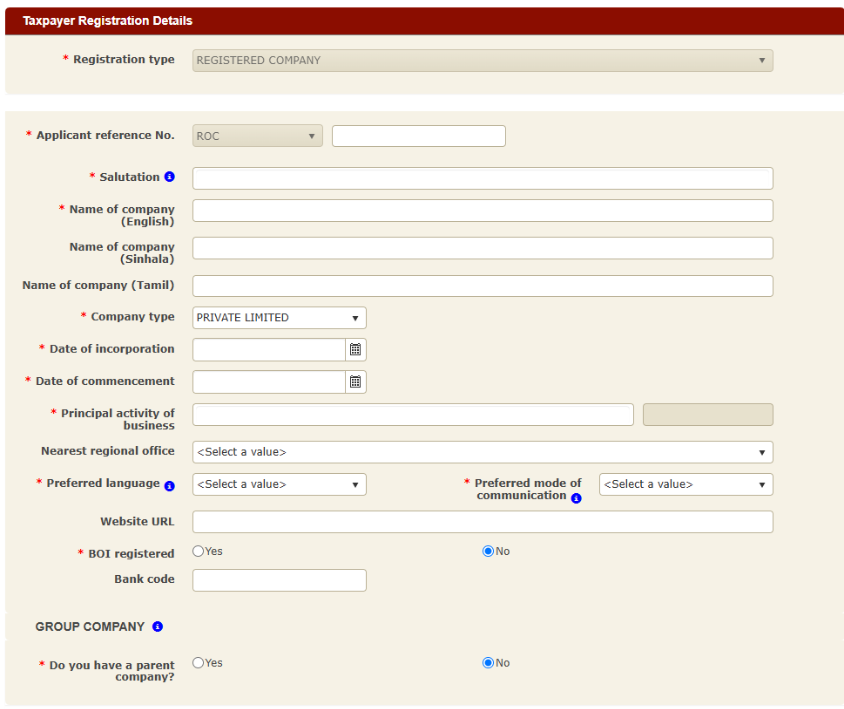

1. Company Details

Fill in these details:

- Company name (in English, Sinhala, and Tamil if available)

- Type of company (e.g., Private Limited)

- Date of incorporation (from your company registration certificate)

- Date you started or will start operations

- Your business activity. (Refer to: Business Activity Codes)

- Website (optional)

- Whether the company is registered with BOI (Yes/No)

- If you have a parent company (Group structure)

Tip: Use the exact names and dates shown in your ROC documents.

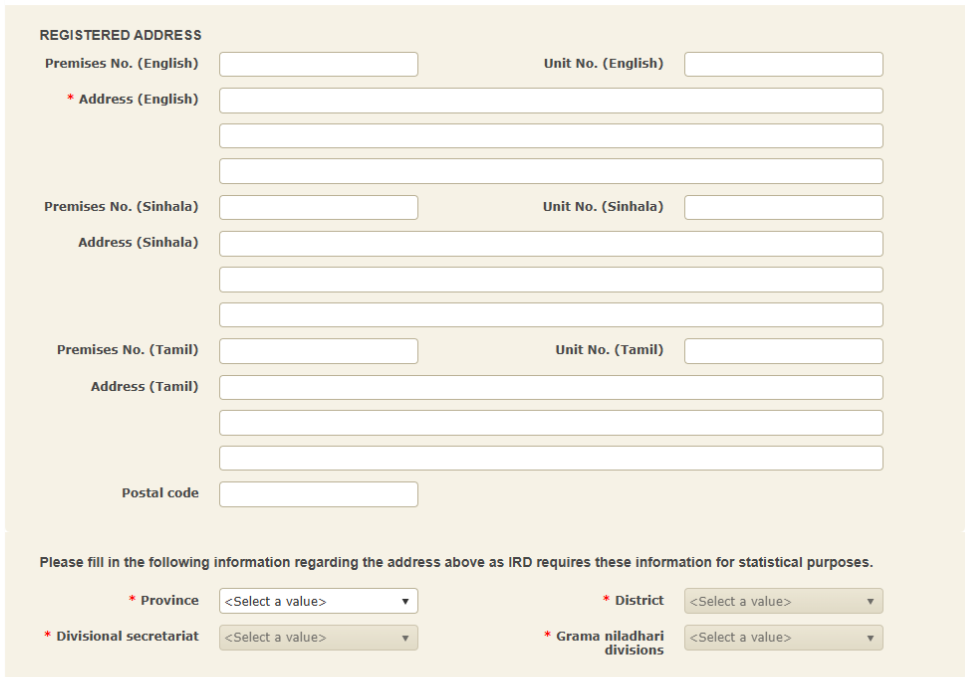

2. Company Address

Fill in your registered address in all 3 languages (if possible). Then choose your:

- Province

- District

- Divisional Secretariat

- Grama Niladhari Division

Tip: Use your business registration address here as per Form 1 or Form 13.

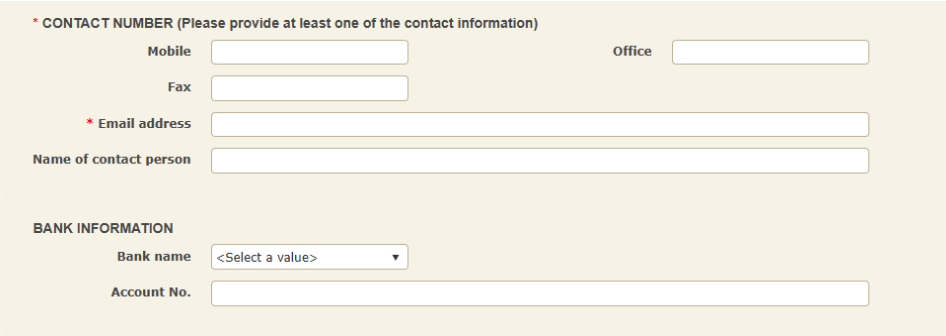

3. Contact and Bank Info

Enter:

- Mobile number and office number

- Your main email address (very important!)

- A contact person’s name

- Bank name and account number

Tip: Use a working email address. You will receive important information like your PIN to log in to the IRD’s system.

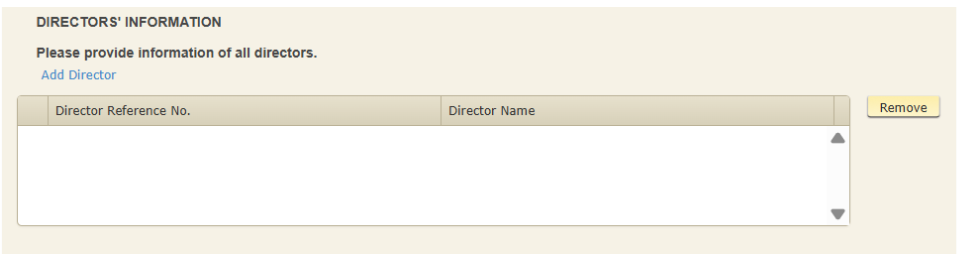

4. Director Details

Click “Add Director” and enter the names of all your directors, just like in Form 01/ Form 20.

Tip: Make sure all directors are added correctly to avoid delays.

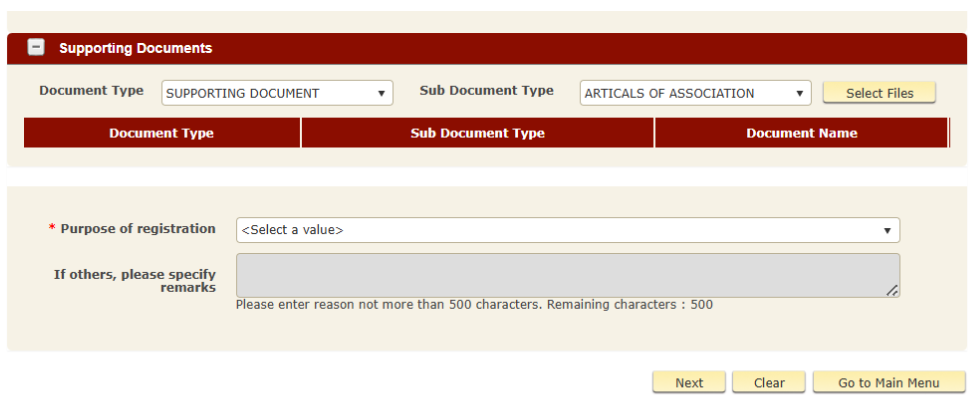

5. Upload Supporting Documents

You will need to upload scanned copies of:

- Certificate of Incorporation

- Form 01 – Initial company registration form

- Form 20 – List of directors (all changes should be updated)

- Form 13 – Address change form (if applicable)

- NIC / Driving License / Passport – For all directors

- Articles of Association – Your company’s legal structure

- BOI certificate and agreement – Only if registered with BOI

Then, select the reason for registration (example: “Tax Purposes”).

6. Submit Application

Before you submit your TIN application, double-check that all information is accurate and complete. Once everything is confirmed, enter the applicant’s details and proceed to apply.

✅ Company details are correct

✅ Address matches ROC documents

✅ All directors added

✅ All required documents uploaded

✅ Email and mobile number are accurate

What’s Next?

After you submit your application, the IRD will review and approve it. Once approved, your Corporate Income Tax (CIT) registration will be activated automatically – you don’t need to apply for it separately.

Here’s what you can expect next:

- You’ll receive a digital copy of your TIN certificate by email.

- The original certificate will be sent to you by registered post.

- You can apply for other tax types such as VAT, APIT, WHT, or SSCL, if needed.

- You’ll be ready to manage all your tax matters online through RAMIS (the IRD's e-Services system).

Setting Up RAMIS Access

Once you receive your TIN, the next step is to activate your RAMIS login.

1. Get Your PIN

Your PIN allows you to log in to the RAMIS portal. It will usually be emailed along with your TIN certificate. If you don’t receive it, you can request it through the IRD e-Services portal or by visiting the IRD office.

2. Apply for SSIDs (Staff Logins)

After your PIN is active, you can apply for SSID logins for your staff or tax agents who will handle tax matters on behalf of the company.

Once your RAMIS login is fully set up, you will begin receiving important tax updates, payment reminders, and notices directly to your registered email address.

If Online Application is Difficult – Apply in Person

If you’re unable to apply online, you can submit your application manually by visiting the IRD Head Office or the nearest regional office. Here’s what to do:

- Visit the IRD office during working hours

- Bring all the required documents in printed form

- Submit them at the registration counter

- The IRD staff will guide you through the manual registration process and help you complete the application

After You Receive Your TIN – What You Should Do

Once you receive your TIN, it’s important to manage your tax responsibilities properly. Make sure to file all tax returns and make payments on time to avoid penalties or legal issues. It’s highly recommended to get support from a qualified tax consultant who can guide you through the process and help you stay compliant.

Always keep your tax records organized, including invoices, receipts, and payment proofs.

Secure your RAMIS login access and never share your PIN or SSID details with unauthorized persons.

Lastly, keep your original TIN certificate in a safe place, as you may need it for bank-related matters, audits, or official requests.